Invest early. Invest often. Invest for growth. These are the basic principles of saving for your child’s college education. The earlier you begin a savings program, the more time you have to benefit from the power of compound interest. For example, if you start saving $200 per month when your child is an infant with a 7% rate of return, …

3 Mistakes to Avoid Before Taking Required Minimum Distributions

Uncle Sam wants your money. He has bills to pay, just like you. And he’s been waiting patiently for decades for you to hand over his share of your tax-deferred retirement dollars. He expects some folks to be stubborn about it, so he has an answer. It’s called a required minimum distribution (RMD), and savers who have money stashed away …

Risk Management and Your Retirement Savings Plan

All investing involves risk, including the possible loss of principal, and there can be no assurance that any investment strategy will be successful. Investments offering a higher potential rate of return also involve a higher level of risk. By investing for retirement through your employer-sponsored plan, you are helping to manage a critically important financial risk: the chance that you …

Six Tips To Take Control of Your Financial Health

Similar to taking care of your personal health by proactively incorporating healthy habits and annual checkups, you can also take control of your financial health when you are proactive and engaged in managing your finances. And also like your physical and mental health, your financial health requires an ongoing commitment and focus in order to get results. Regardless of your …

Should You Pay Off Your Mortgage or Invest?

Owning a home outright is a dream that many Americans share. Having a mortgage can be a huge burden, and paying it off may be the first item on your financial to-do list. But competing with the desire to own your home free and clear is your need to invest for retirement, your child’s college education, or some other goal. …

Paying for College and the Impact of COVID-19

With the coronavirus shutting down educational institutions and moving classes online, the face of education across the country has changed. While the focus has been primarily on completing the educational requirements to get K through 12 students through the end of the year, colleges and universities have been particularly hard hit as well. Not only is attendance down and funding …

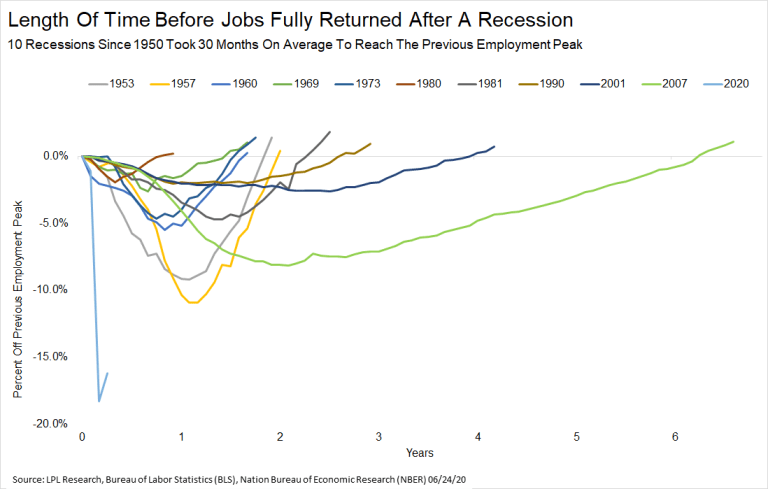

When Will The Economy Recover?

The economy is moving in the right direction, as many economic data points are coming in substantially better than what the economists expected. From May job gains coming in more than 10 million higher than expected and retail sales soaring a record 18%, how quickly the economy is bouncing back has surprised nearly everyone. “As good as the recent economic …

Hats Off to Public Service Workers During the Coronavirus

While many people have been furloughed and others are working from home, public service workers have continued to show up at work every day as the COVID-19 spread through the United States. During Public Service Recognition Day, we’d like to take a look at the tireless efforts these people are making while dealing with the coronavirus crisis on the front …

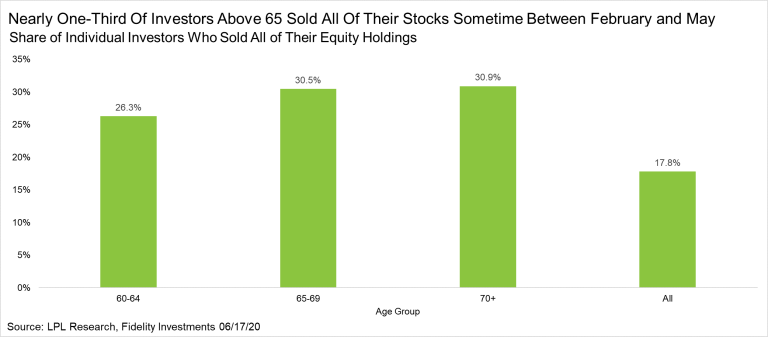

3 Charts That Have Our Attention

Stocks have shaken off the 5.9% S&P 500 Index drop last Thursday by gaining three days in a row before yesterday’s modest weakness. While researching and reading this week, three charts stood out that tell us quite a good deal about how investors have reacted during this volatile market and what could be next. Incredibly, we saw nearly a third …

Ideas for Reducing the Cost of College

Encourage your student to think about their future financial self  Mid-August is the time of year that our kids pack the U-Haul and head to college. And while they’re excited about a brand-new semester, it can be frightening to see the cost – and rising college debt – that comes with the college experience. What can our college students …