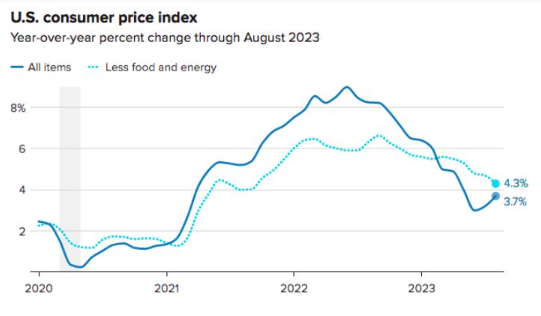

On September 13, 2023, it was announced that August saw inflation record its biggest monthly increase for all of 2023 as energy prices rose significantly. Specifically, the Department of Labor reported that the Consumer Price Index (CPI), which measures costs across a broad array of goods and services, rose 0.6% for the month, and was up 3.7% from a year ago.

Contributing to much of the gain was the fact that energy prices rose 5.6% in August, including a massive 10.6% jump in gasoline prices. Further, food prices rose 0.2% while shelter prices rose 0.3%.

Reading media reports of the Department of Labor’s Consumer Price Index, however, might lead one to believe that inflation was in check, as core CPI, which excludes food and energy prices, “only” rose 0.3% for the month and 4.3% for the year. Why? Well, because in the world of central banking, the Federal Reserve prefers to focus on core inflation.

The rationale behind this exclusion is to get a clearer picture of the underlying inflationary pressures in the economy.

However, for retirees living on fixed incomes, excluding energy and food prices from the inflation equation is a luxury they cannot afford. These essential expenses impact their daily and future lives, making it crucial to consider a more comprehensive approach to understanding inflation.

The Fed’s Focus on Core Inflation

The Federal Reserve uses this metric to assess the overall price stability in the economy. The reasoning behind this exclusion is that energy and food prices tend to be more volatile and subject to short-term fluctuations. By focusing on core inflation, the Fed aims to gauge the underlying, more stable inflationary trends.

The Fed’s concern is that including energy and food prices can lead to misleading conclusions about the economy’s inflationary pressures. For instance, a sudden spike in oil prices due to geopolitical events may not necessarily represent a sustained inflationary trend, and including such spikes could result in unwarranted monetary policy responses.

But Retirees Live in the Real World

While the Fed’s approach to core inflation may make sense from a macroeconomic standpoint, it doesn’t fully reflect the reality faced by retirees.

Retirees, especially those living on fixed incomes, are disproportionately affected by increases in energy and food prices for several reasons:

Budget Impact: A significant portion of retirees’ budgets goes towards necessities like groceries and utilities. These expenses represent a more substantial share of their income, making them particularly sensitive to increases in food and energy prices.

Limited Income Growth: Retirees typically rely on fixed sources of income, such as pensions, social security, and retirement savings. Unlike workers who may receive wage increases to offset inflation, retirees have limited opportunities to increase their income.

Healthcare Costs: Rising healthcare costs, often excluded from core inflation measures, are a significant concern for retirees. Healthcare expenses are an essential part of their budgets and are not exempt from the impact of inflation.

Inflation Lags: Retirees often feel the impact of inflation before it fully registers in official statistics. As prices rise, they may need to cut back on other expenses or deplete their savings sooner than anticipated.

Social Security: Social security cost-of-living adjustments (COLAs) are meant to help retirees keep pace with inflation. However, these adjustments do not always fully account for rising expenses, particularly in essential categories like healthcare and housing.

Energy’s Big Role in Inflation

Energy, particularly oil, has a significant influence on the overall price level of goods and services. When energy costs rise, they impact various sectors of the economy, causing a ripple effect that touches nearly every aspect of daily life and investment decisions.

Transportation Costs: High oil prices directly affect transportation costs, leading to increased prices for shipping goods, commuting, and traveling. Airlines, in particular, are sensitive to oil prices, as fuel accounts for a substantial portion of their operating expenses. Consequently, rising energy costs can lead to more expensive air travel, impacting both consumers and investors in the airline industry.

Plastics and Manufacturing: Oil is a primary ingredient in the production of plastics, chemicals, and various industrial materials. As oil prices rise, the cost of manufacturing increases, subsequently pushing up prices for a wide range of products, from consumer goods to industrial equipment.

Food Costs: Energy plays a critical role in the agricultural sector. Rising energy prices can lead to higher costs for farming equipment, transportation of food products, and the energy needed to run agricultural operations. These increased expenses are eventually passed on to consumers in the form of higher food prices.

The Need for a Comprehensive Approach

Retirees cannot afford to dismiss energy or food prices when assessing the impact of inflation on their financial well-being. While the Fed’s focus on core inflation serves its purpose in macroeconomic policy-making, it does not reflect the everyday realities faced by retirees.

A more comprehensive approach to measuring inflation, one that acknowledges the essential nature of energy and food costs, is essential for retirees pursuing financial independence.

For retirees, financial planning should involve strategies that account for the unique challenges posed by inflation, particularly in energy and food prices. This may include adjusting spending habits, diversifying to help preserve investments from rising costs, and seeking out retirement communities or areas with lower living expenses.

In today’s economic climate, staying informed about how energy and food contribute to inflation is essential for financial independence and working towards a confident retirement.

Important Disclosures

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

Core Inflation is a measure of inflation that excludes certain items that face volatile price movements. Core inflation eliminates products that can have temporary price shocks because these shocks can diverge from the overall trend of inflation and give a false measure of inflation.

This article was prepared by FMeX.

LPL Tracking #479407