|

The upcoming election and COVID 19 Update: The fourth quarter of 2020 has officially begun. Good riddance?? I’m not sure what word to use to describe the feeling of entering the final quarter of what has been undoubtedly one of the most bizarre and “unprecedented†years in recent memory. COVID 19 continues to hang around while the stock market has shown signs of optimism in our economic recovery. Our president and some of his staff were infected with the virus a month before the election and just a couple of days after the first presidential debate.

Might I add, it was a debate like no other debate that we have ever witnessed. There is a common consensus that 2020 will go down as a year to remember (or forget), but there is still a lot to see play out before the end of the year.

The Election: What will happen in November is to be determined. One thing that most will agree on is that we may not know who the president will be on November 3rd. With mail-in ballots required to be postmarked on November 3rd, it could be several days after election day when the final votes are counted. Assuming one party concedes the election at that time, we may know a few days after November 3rd.

However, if we see disagreement between the parties on who the winner of the election is, we could see a scenario such as the year 2000, when it took several weeks or even longer for a definite answer as to who will be our President in January.

As of now, the market has not shown normal election year volatility leading up to election day. With a few exceptions, the market has remained relatively steady over the past couple of months and through the first round of debates. That said, many believe that if Biden gets elected, based on his plan to raise corporate taxes, the market will trade lower. The counterpoint to this argument is that Biden is leading strongly in the polls, so the market has likely priced in the fact that he has a strong chance of winning the election, and the market has continued to stay strong. Another avenue of thought is that the polls may not be as reliable as they have been in the past. 2016 was a good example of the polls being a poor reflection of how the actual vote turned out.

If it takes the government a month or two after the election to declare a clear winner, we could certainly see a scenario that uncertainty and anxiety about future policy creates some volatility in the market. Based on this information, we are continuing to stay mostly invested in our models while holding a bit higher than normal cash positions in most of our retirement accounts in an attempt to hedge the possibility of volatility or a market correction. This allows us to purchase some assets at a lower level if the market does move lower temporarily.

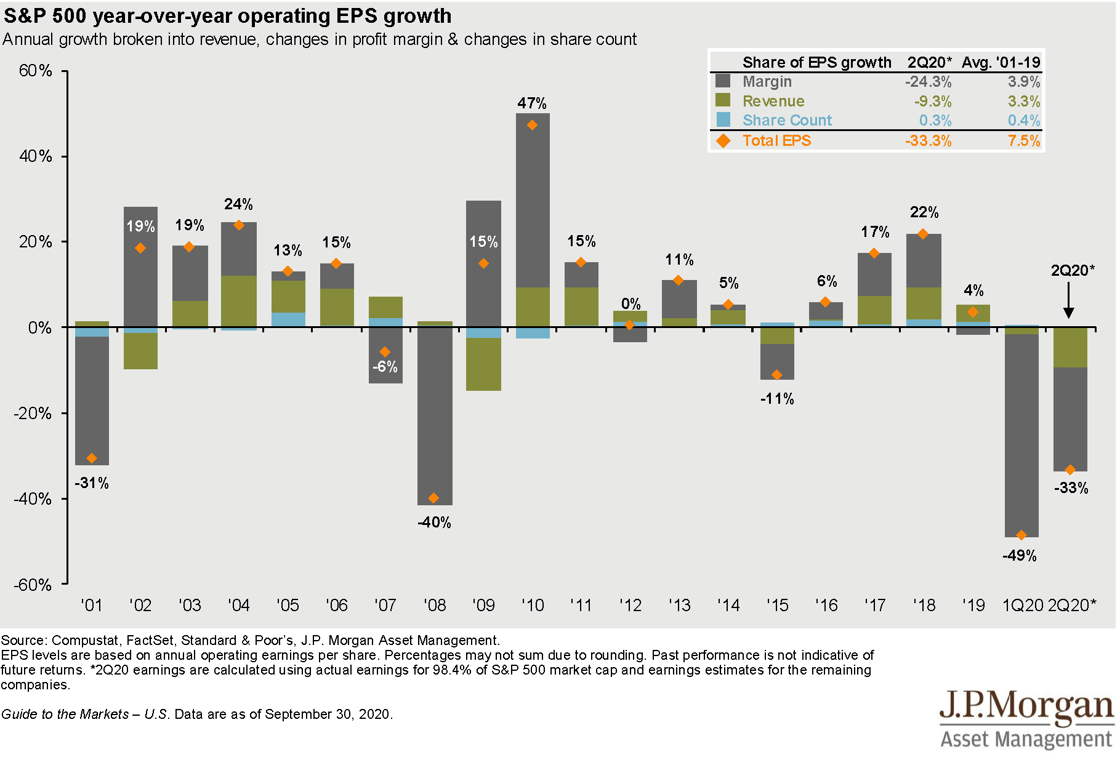

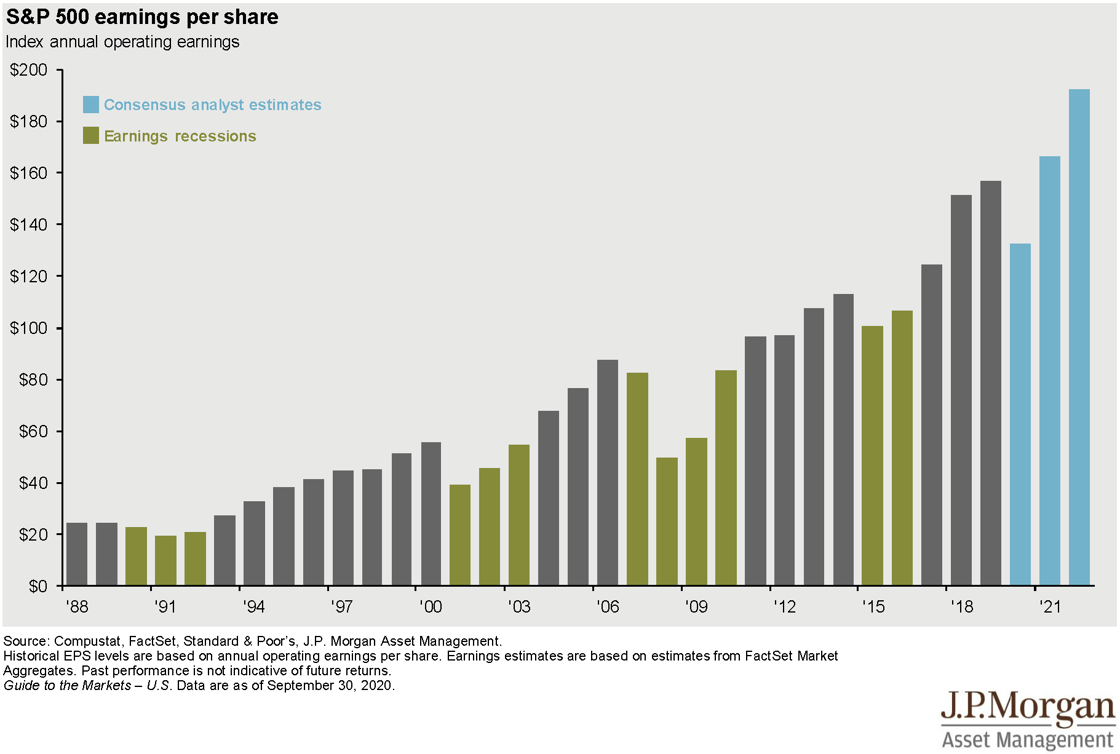

COVID 19 and the Market: According to JP Morgan Guide to the markets, company Earnings Per Share growth was down 33% in the second quarter from Q2 of 2019. We will soon get numbers from the third quarter and we expect that they will look better than the second quarter, but still off from Q3 of 2019.

|

|

|

This leads us to the question on everyone’s minds: Why is the market still trading at near-record highs? As stated above, the market is pricing in a strong economic recovery from the virus. It is trading based on future expected earnings and not current earnings, which is not uncommon in the marketplace. We always remind our clients that the stock market can be a reflection of where the economy is expected to be in six to nine months as opposed to where it is today. It is a “leading economic indicatorâ€. |

|

|

There are reasons to be optimistic based on large strides toward getting a vaccine as well as advanced testing that will give results very quickly. This allows people to get tested and go about their lives and may also ease restrictions on gatherings by requiring people to take quick tests before events and making people less wary of traveling on an airplane.

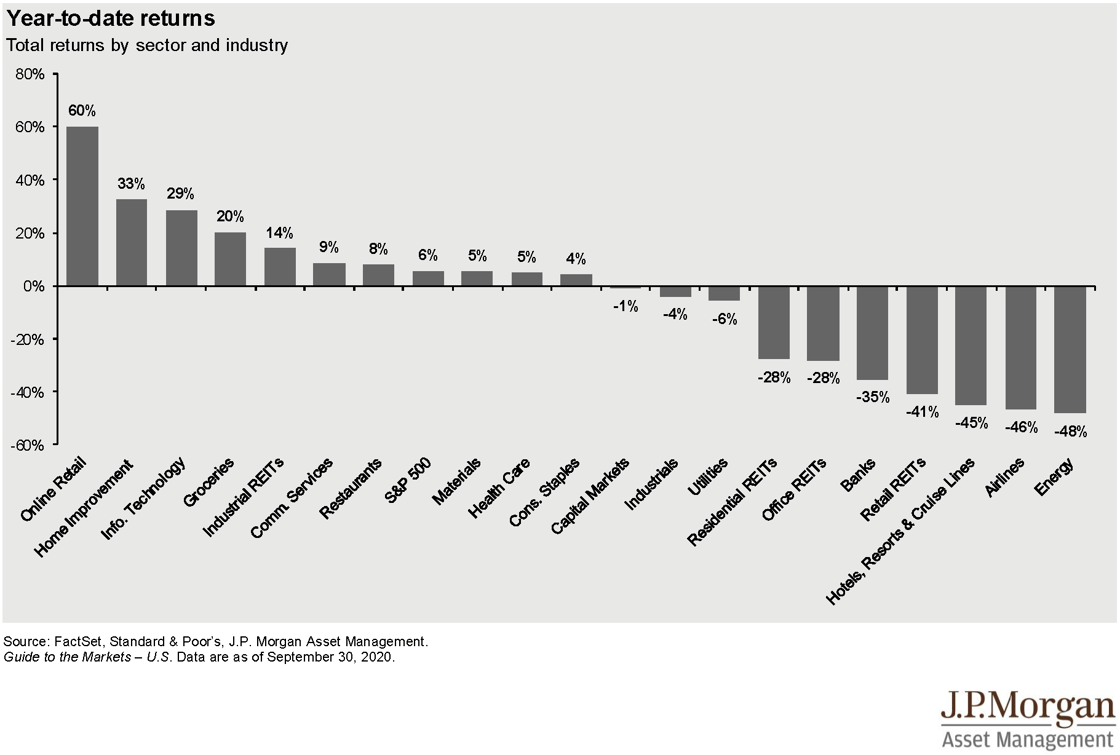

There are still uncertainties that will play out over the coming months and years. The economic fallout from COVID has hit many small businesses hard, which could have a negative impact on banks. We have seen tech and growth stocks recover quicker than large dividend-paying stocks, such as some big banks, real estate, and energy companies and this could be a reflection of a long-term shift as to what assets perform the best in the years to come. |

|

|

We are focused on helping our clients maximize every “situational†planning opportunity (Tax harvest, Roth Conversion, Account Consolidation, Life Insurance Coverage, etc.) that we can while our investment committee is diligently seeking the best investment opportunities for our clients.

We wish you a Happy Halloween and hope that you are finding great ways to enjoy the cooler temps and beautiful weather this fall.

Sincerely, Jeb Graham CEO/Owner Metcalf Partners

|